Currency Correlation in Forex Market

Understand how currency pairs move in relation to one another

1. What is Currency Correlation?

Currency correlation refers to the degree to which two currency pairs move in relation to each other. Traders use it to manage risk and identify diversification or doubling of exposure. For example, EUR/USD and GBP/USD often move together due to their shared relationship with the USD. If two pairs have a strong positive correlation, they typically rise and fall together. A negative correlation means they move in opposite directions. Understanding correlation is key to planning your trades strategically. It helps in avoiding unintentional overexposure. You can also spot new opportunities when pairs diverge unexpectedly. Currency correlation can be measured over different time frames for dynamic analysis. It’s a vital tool in a trader's technical arsenal.

:max_bytes(150000):strip_icc()/positive_correlation-ccf11d04abb7420ab6502565d1e52768.jpg)

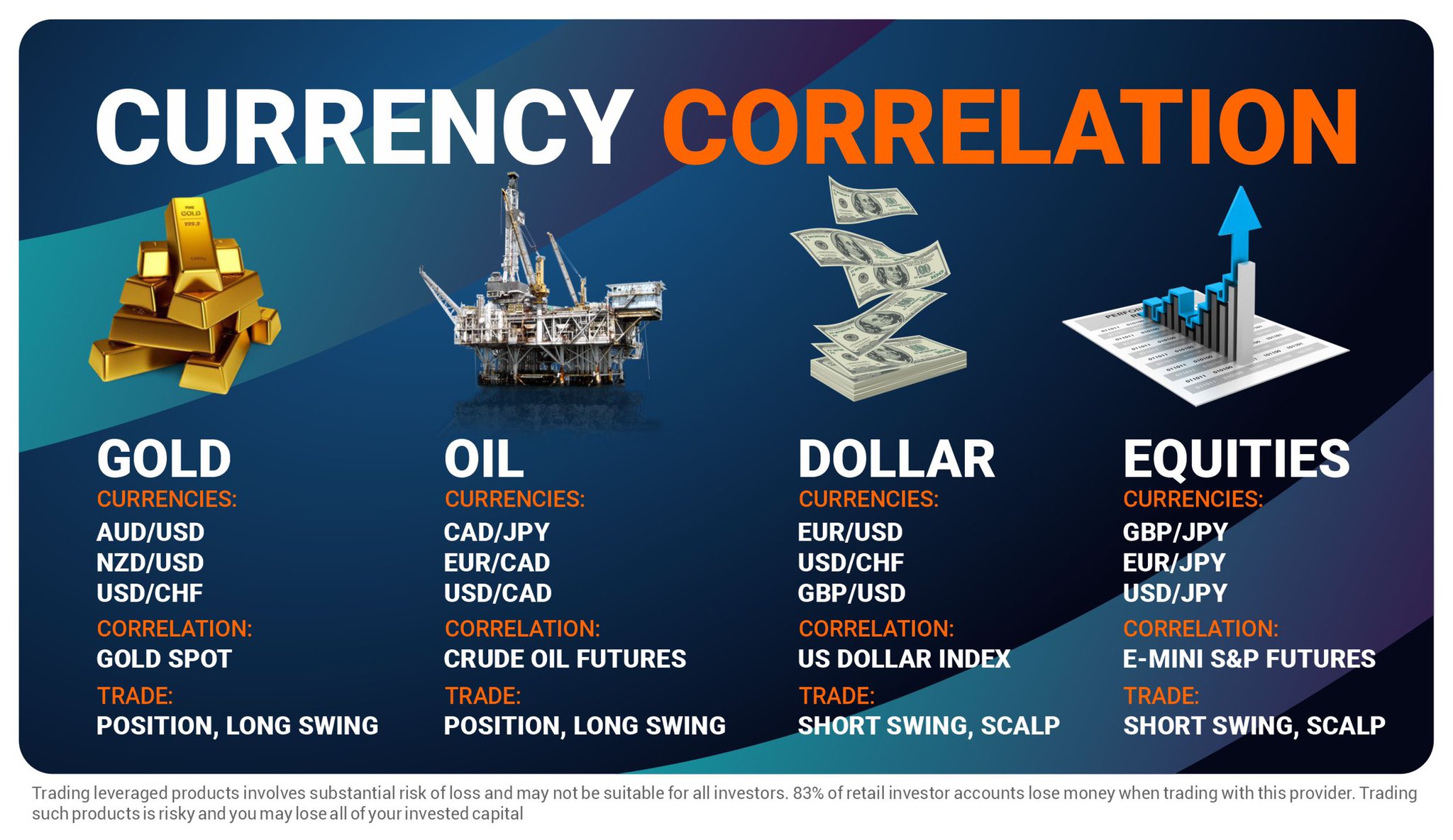

2. Positive Correlation

A positive correlation occurs when two currency pairs move in the same direction. For instance, EUR/USD and GBP/USD often show a strong positive correlation. This means if EUR/USD goes up, GBP/USD likely rises too. These pairs are influenced by similar economic factors like US interest rates. Positive correlation helps traders spot reinforcement trends. But trading both may double your risk unknowingly. Use it to hedge similar trades or confirm trends. It’s also useful in long-term portfolio balancing. Keep monitoring changes over time, as correlation can shift. Tools like correlation matrices make tracking easier.

3. Negative Correlation

A negative correlation occurs when two pairs move in opposite directions. An example is EUR/USD and USD/CHF. When EUR/USD rises, USD/CHF often falls. This happens because both pairs are connected to the US Dollar, but in reverse order. Traders use negative correlations to hedge positions effectively. It helps balance risk by taking offsetting trades. Also useful for advanced strategies like straddling. Be cautious—correlation strength can vary with market sentiment. Always verify with updated data. Understanding this inverse relationship boosts risk management.

4. No or Weak Correlation

No correlation means the price movement of two pairs is unrelated. USD/CAD and AUD/NZD may show very low correlation at times. It indicates that external or independent factors drive them. This type of correlation offers diversification. Traders can reduce portfolio risk with uncorrelated trades. But also remember: low correlation doesn’t mean zero impact. Political or global news can temporarily sync unrelated pairs. Use statistical tools like Pearson coefficient for clarity. Keep monitoring for sudden shifts in behavior. Weak correlations can be unpredictable—watch out.

5. How Traders Use Correlation

Traders use correlation to manage exposure and avoid redundant trades. If two trades are highly correlated, it can increase your risk. For example, buying both EUR/USD and GBP/USD may double exposure to USD movement. Traders can also use it to hedge—take opposite trades on negatively correlated pairs. It's also used to confirm signals from one pair with another. Correlation helps spot new opportunities during divergence. Advanced systems use it in portfolio optimization. It's also key in algorithmic and quant trading. Visual tools make pattern recognition easier. Overall, it's essential for informed decision-making.

6. Currency Correlation Comparison Table

Average correlation values between common forex pairs:

| Pairs | EUR/USD | GBP/USD | USD/JPY | AUD/USD | USD/CHF | NZD/USD |

|---|---|---|---|---|---|---|

| EUR/USD | 1.00 | 0.89 | -0.75 | 0.81 | -0.91 | 0.85 |

| GBP/USD | 0.89 | 1.00 | -0.62 | 0.77 | -0.85 | 0.82 |

| USD/JPY | -0.75 | -0.62 | 1.00 | -0.58 | 0.79 | -0.65 |

| AUD/USD | 0.81 | 0.77 | -0.58 | 1.00 | -0.84 | 0.88 |

| USD/CHF | -0.91 | -0.85 | 0.79 | -0.84 | 1.00 | -0.73 |

| NZD/USD | 0.85 | 0.82 | -0.65 | 0.88 | -0.73 | 1.00 |

7. Future Enhancements & Suggestions

The world of currency correlation is evolving rapidly with AI-driven tools and real-time analytics. One future enhancement is a live heatmap showing dynamic correlations across pairs and timeframes. Interactive filters could allow traders to sort by strength, direction, or volatility. A trade impact calculator would show how much exposure you're doubling or hedging based on correlation. Integrating macroeconomic news overlays would help detect cause-effect patterns. Backtesting tools could simulate strategies based on historical correlations. Mobile-friendly dashboards would help on-the-go trading decisions. Additionally, AI could recommend pair combinations based on shifting sentiment. Correlation trend charts over months or years would reveal seasonal behaviors. Lastly, brokers might soon offer correlation-based alerts to warn users of double-risk. These upgrades will greatly benefit modern forex traders.