Beginner's Guide of Forex Market

1. What is Forex Market?

The Forex market is the global marketplace for trading national currencies. It operates 24 hours a day, five days a week and is the most liquid financial market in the world. Traders speculate on currency values in pairs, such as EUR/USD, aiming to profit from fluctuations in exchange rates.

2. How Forex Trading Works

Forex trading involves buying one currency and selling another simultaneously. Traders use platforms provided by brokers to open positions on currency pairs. Success depends on predicting which currency will strengthen or weaken relative to another.

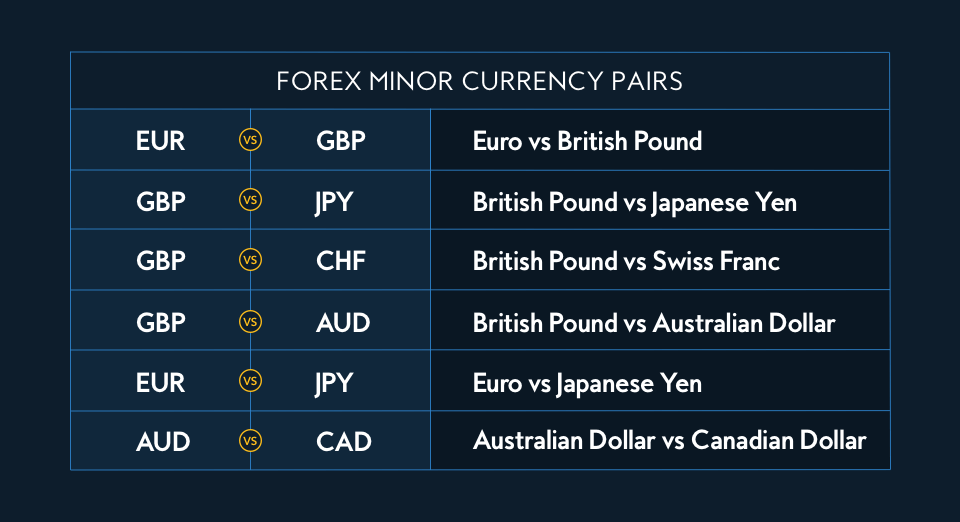

3. Major & Minor Currency Pairs

Major pairs include the most traded currencies like EUR/USD, USD/JPY. Minor pairs exclude the US dollar and include combinations like EUR/GBP. Beginners should start with major pairs due to their liquidity and lower spreads.

4. Key Forex Terminology

Terms like pips (price movement), spread (buy/sell price difference), lot size (trade volume), and leverage (borrowed funds) are essential to understand. These form the core of trade setup and risk calculation.

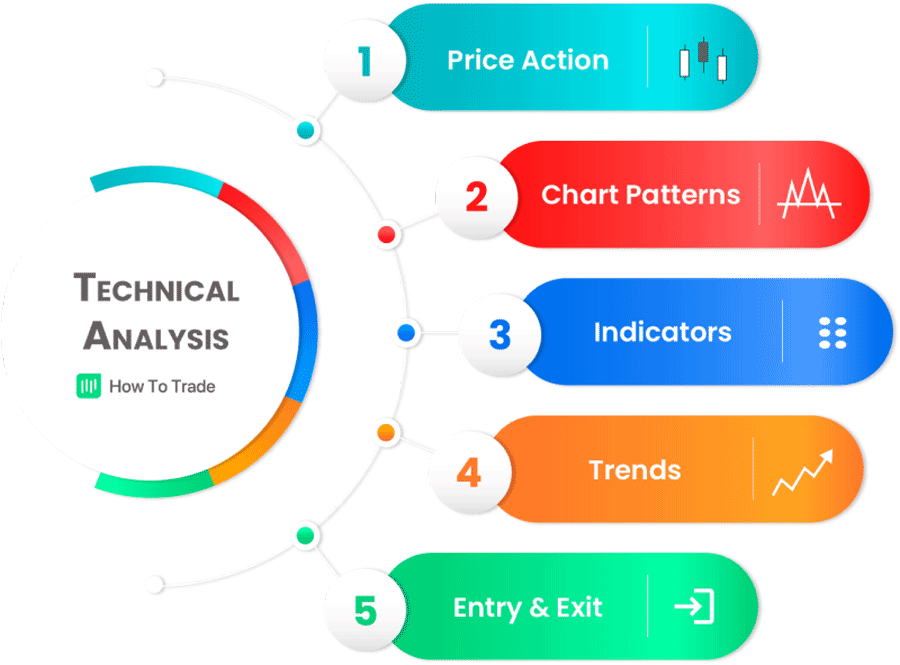

5. Forex Analysis Types

Technical analysis uses charts to predict market movements. Fundamental analysis focuses on economic data and news. Sentiment analysis gauges the overall mood of traders. Combining all three enhances decision-making.

6. Risk Management

Successful trading means protecting your capital. Use stop-losses, control position sizes, and never risk more than 1–2% per trade. Risk management helps avoid large losses and ensures longevity in the market.

7. Selecting a Forex Broker

Choose a regulated broker with low spreads, fast execution, and strong customer support. Ensure they provide a secure trading platform and educational resources for beginners.

8. Practice with Demo Account

Start with a demo account to learn how the market works without risking real money. Practice executing trades, using indicators, and testing your strategies under real market conditions.

9. Trading Psychology

Controlling emotions like fear and greed is key. Stick to your plan, avoid revenge trading, and maintain discipline. A calm mindset leads to better decision-making.

10. Common Beginner Mistakes

New traders often overtrade, ignore risk management, or follow tips blindly. Avoid jumping from one strategy to another. Learn from mistakes and focus on consistency.